Employer retention credit calculation

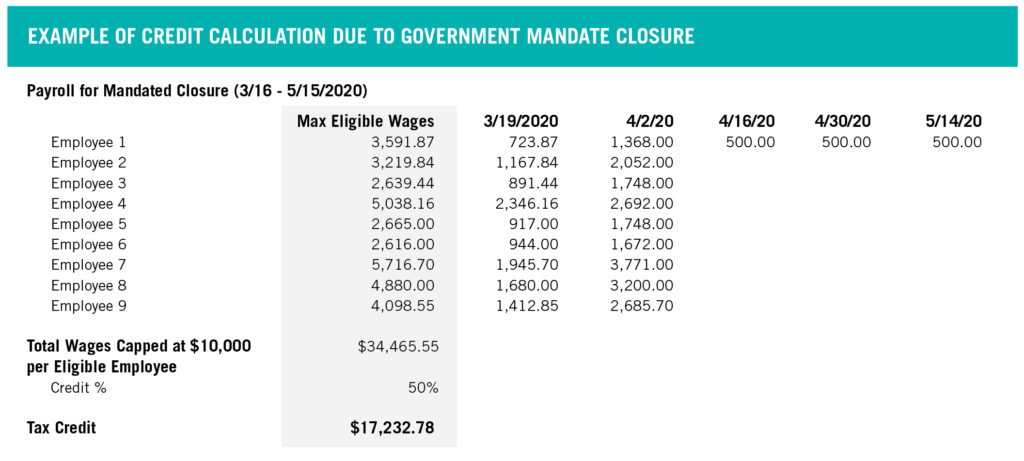

The first eligibility situation for the Employer Retention Credit is when a state or local government puts out a formal order. This means for every eligible employee.

Changes To The Employee Retention Credit Erc

A refund for employee wages paid in 2020 claim your refund credit of up to 5000 per employee only.

. The benefits of calculating your employee retention credit include. Calculate your total qualified wages. EY Employee Retention Credit Calculator The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES.

The TCDTRA extends the ERC to June 30 2021. Calculate your ERC using the rate applicable to that quarter. 50 of qualified wages 10000 per employee for the year including certain health care expenses 100 or fewer average full-time.

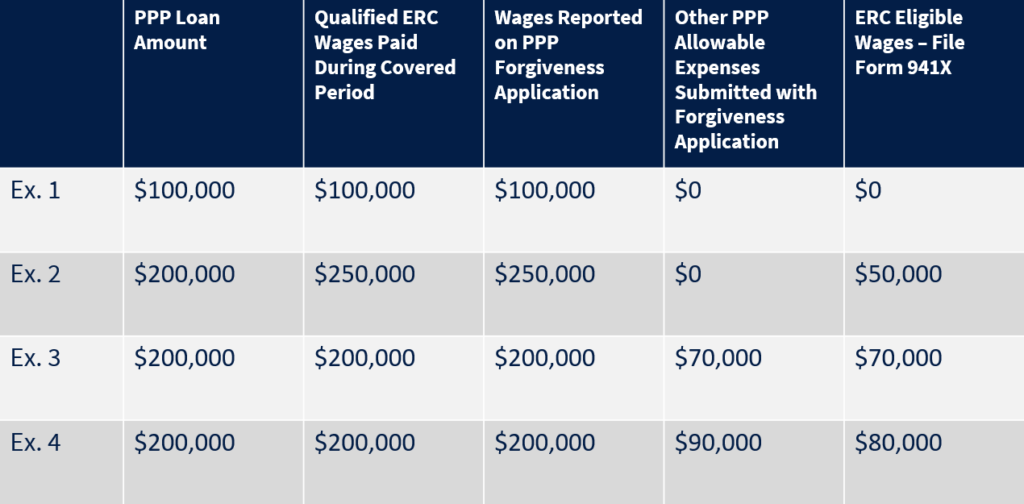

Wages paid between Jan. Employers who qualify including PPP recipients can claim a credit against 70 of qualified wages paid. The ERC calculation is based on total qualified wages including health plan expenses paid by the employer to the employee.

Employee Retention Credit. Heres how to calculate the ERC tax credit. Percent of qualified wages eligible for credit.

Additionally the amount of wages that qualifies for the credit is now. The ERC equals 50 percent of the. The maximum tax credit you can receive with Employee Retention Credit is 7000 per employee per quarter which adds up to 28000 per year.

You can claim up to 7000 of their wages. 1 2021 and June 30 2021 now qualify and are subject to the new more favorable credit calculations. Receive a credit of around 50 for 10000 from each of the employees wages.

Thus the maximum employee retention credit available is 7000 per employee per calendar quarter for a total of 14000 for the first two calendar quarters of 2021. Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. For 2021 employers can take a 70 credit for each of their qualified employees per quarter.

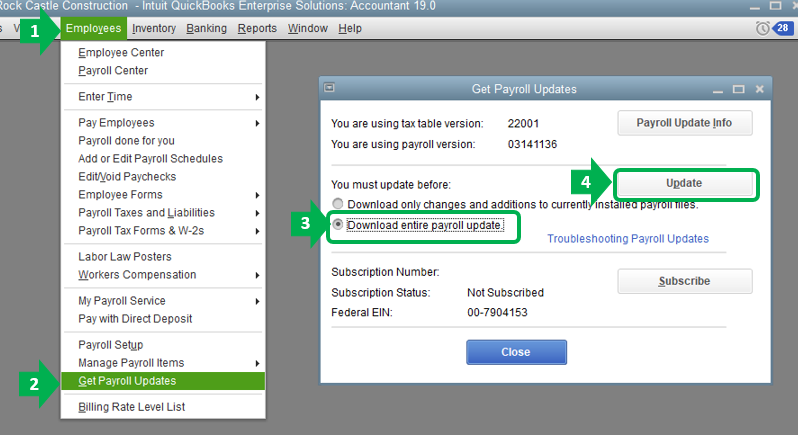

Receive your credit by either getting an advance payment or claiming a refund. Your business needs at least. Old Law New Law Eligible Employers 2020 2021 Eligible employers can receive a refundable payroll tax credit of 50 of wages paid to employees between March 13th 2020 and.

Assess group health plan fees to be qualified.

2

Employee Retention Credit Erc Calculator Gusto

Employee Retention Credit Erc Calculator Gusto

Determining What Wages To Use For The Ertc And Ppp Youtube

Employee Retention Credit Irs Updates Guidance On Ppp Coordination Issues And More Sc H Group

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Covid 19 Relief Legislation Expands Employee Retention Credit Insights Ksm Katz Sapper Miller

Employee Retention Credit Spreadsheet Youtube

2

Employee Retention Credit Worksheet 1

Employee Retention Tax Credit On 941

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

Employee Retention Tax Credit On 941

2

Determining What Wages To Use For The Ertc And Ppp Youtube

Calculating Your Employee Retention Credit In 2022

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek